ICT Liquidity Trading

ICT Liquidity Trading Is One Of the important things to know before you trade the ict concepts, liquidity is the important thing when you understand this you can anticipate the price to move in a bull or bearish direction.

If You are a Beginner if you want to understand the liquidity pools, This blog post is for that only I have shared the inner circle trader concepts to identify the liquidity pools.

What are ICT Liquidity Pools?

Liquidity pools are one of the important levels to make sure the price going to reverse or retrace from a certain point, to understand more in-depth if you identify the certain ICT liquidity pool on your own then you can find the institutional order flow.

ICT Liqudity pools are the only way to easily identify the market’s bullish or bearish trend or reversal, before every expansion the market does certain things such as pairing the liquidity.

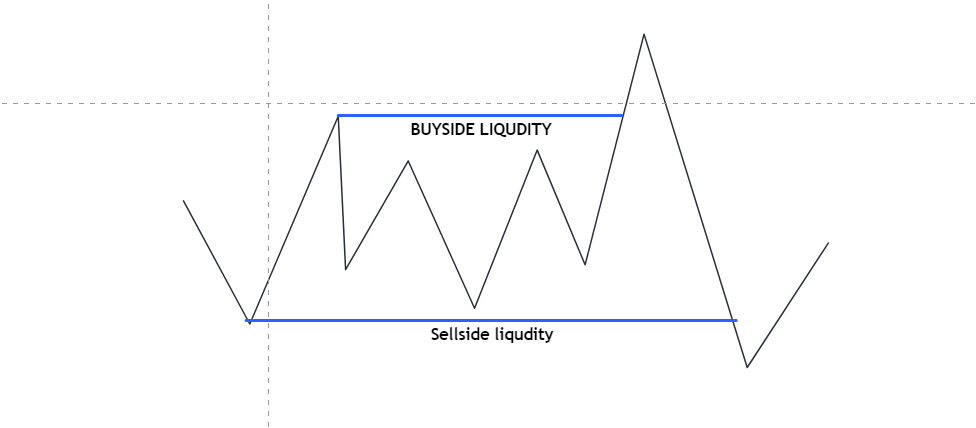

There Are 2 types of liquidity on the markets which are buy-side liquidity and sell-side liqudity.

ICT Buyside Liqiudity

Buy-side liquidity is where the smart money players are willing to see for sells, This is because of the retail traders because they buy above the highs, this is how you should look for sells above the highs.

To understand in-depth let’s see about the Swing Highs, Swing Highs are the liquidity pools at a certain key level the market will reverse at the point of interest.

When The ICT liquidity Pool Hits You have to conform with certain of things to enter a trade that is explained below.

In This Eurusd Price action, you can see that the price took the previous six months’ highs and then the market reversed, This is because the market makers are willing to sell above the highs, the higher time frame swing highs are the powerful liquidity pools.

After taking the buy side liquidity the market makers will move the price to sell side liquidity which is where you have to put your take profit, After taking the 3-month-old high you can see how the market displaced below that is the power of ict liquidity trading.

ICT Sellside Liquidity

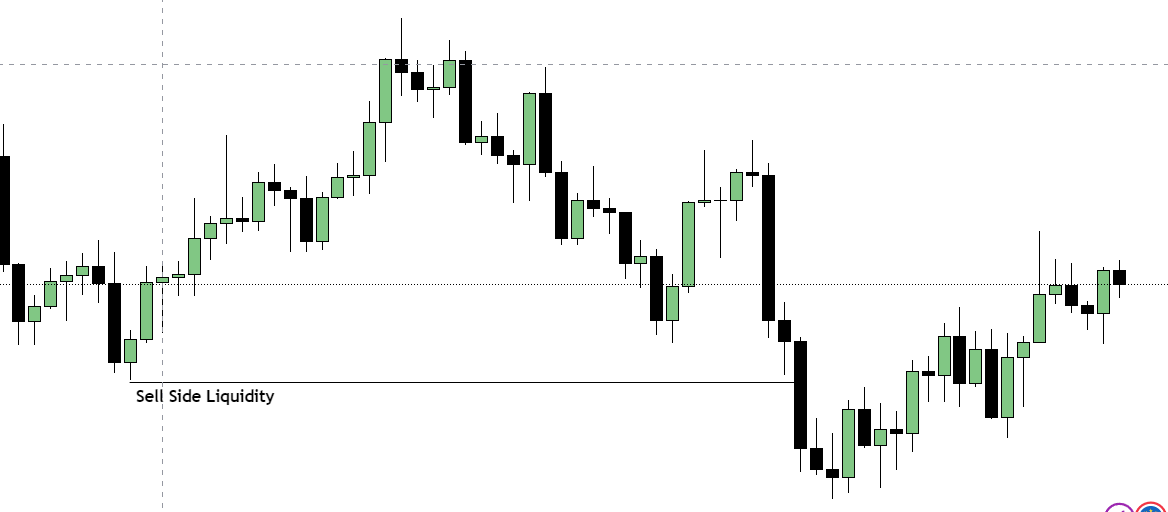

Sell-side Liqudity pools is buying on the market price when the price sweeps or purges, The sell-side liquidity pools are old lows or higher time frame PD arrays.

After you anticipate the price to come below an old low you can take buys from there you can target the highs, don’t forget that ict liquidity trading is always based on Buy Below the old low .

When The Market is In one direction Bearich you can expect the sell-side liquidity has been purged.

Here you can see that the market takes the old low which is the ict sell-side liquidity, this is a power full to trade because the market was ranged for a few days and it took the old lows.

In this situation, the breakout traders will sell below the low the market will take their liquidity and the market will move higher.

How To Trade ICT Liquidity

To Trade the ict liquidity pools first of all you have to identify the market structure of the pair, If identify whether you are in an up or down trend because if you are in an up trend the market will move to the buy stops.

If we are in the down or the bearish trend the market will move towards the sellstops in between you have to plan a trade idea.

Final Thought

When You Are Trading This You Have To Think like The markets Makers , Everthing Thing is running behind the logic if you want to know more in ict trading concepts see our website , Im writing this blog post hours and hours to make the beginners to understand If you are like please share with your Friends , thankyou stay safe.

Hi Iam, A Trader since 2019 And I have a Good Amount Of Experience In various Markets Forex, Futures, and Options and I using ict concepts since 2021 After Using ICT I became Profitable So I Created This Blog To Make Others Getting Knowledge On trading.