INTRODUCTION

Hello Traders In this Blog we are going to see what is [irl to erl] internal range liquidity and external range liquidity , The inner circle trader gave us a good detailed explanation about this and he was given a lot of gems, So this is a good gem post for you guys.

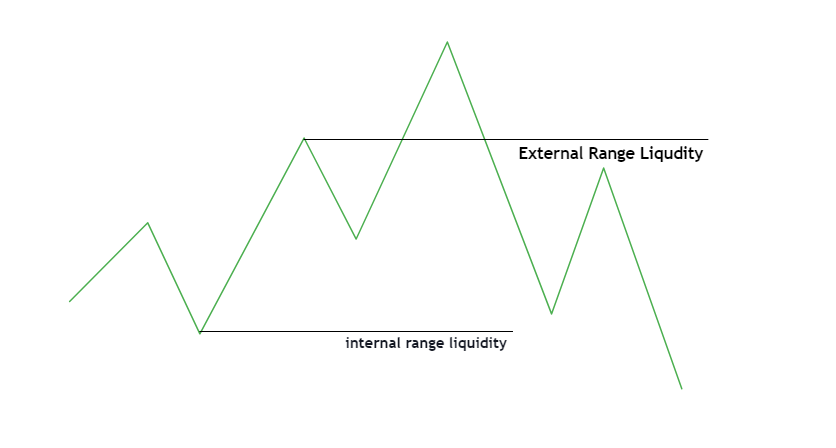

What is IRL TO ERL

The Full form of the Irl to erl means – internal to external range liquidity, this is one of the most important parts of the ICT concepts, and when you learn this, it increases your trading curve.

To learn more in-depth we are going to see some examples of the internal range liquidity, There are specific PD arrays it has given to us.

Internal range liquidity includes Fair Value Gap, Order Block, breaker Block, etc. We have already learned the market will do 2 things: imbalance to Liquidity And Liquidity To Imbalance.

The market Will Always move from Irl To Erl When it is in an uptrend the market will move upwards and seek for the internal range Liquidity.

How To Trade IRL TO ERL :

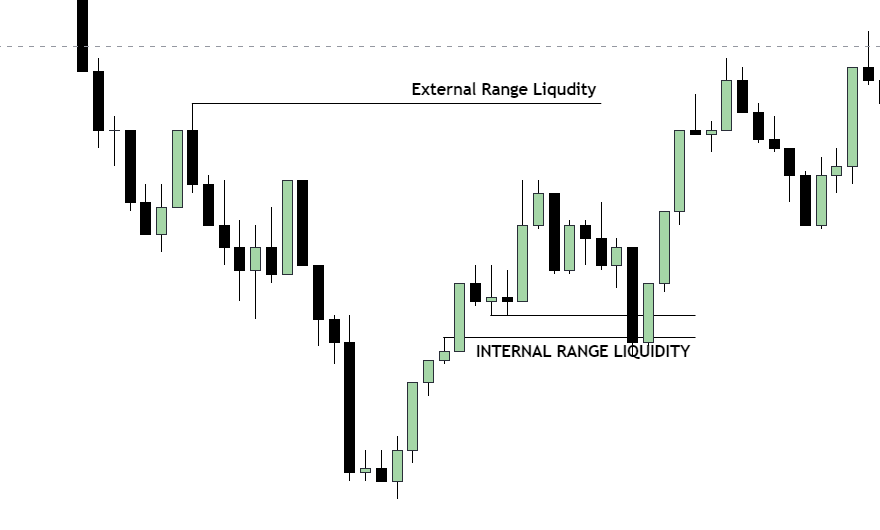

If you want to trade IRL TO ERL strategy all you have to do is see the structure when the market moves in the Bullish direction you have to look for the swing highs and fvg.

When the market is moving downwards which is bearish you have to look for the swing low and the internal security as an FVG.

Advance Conformation Entry :

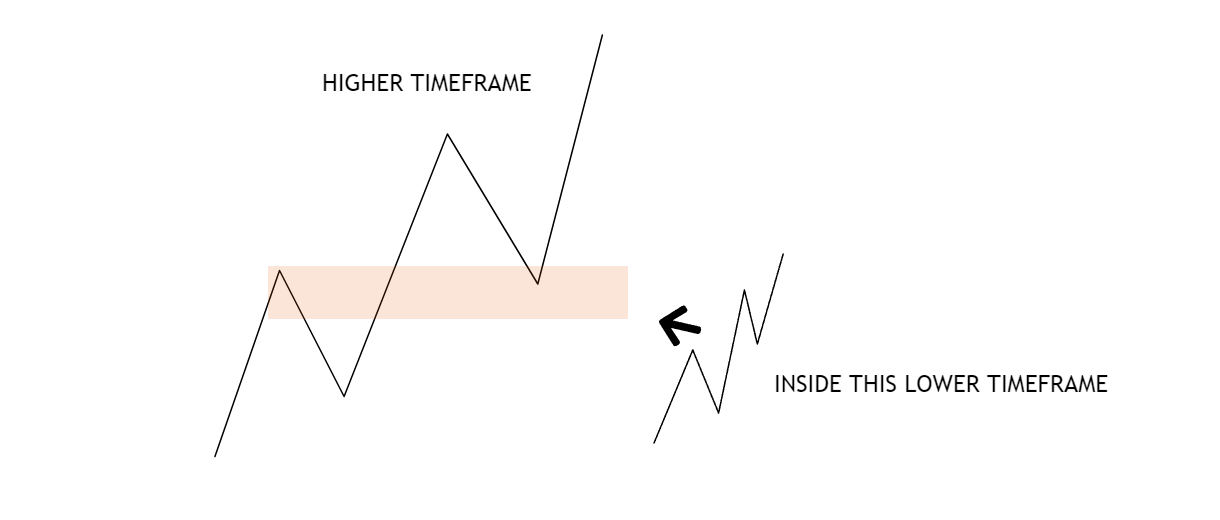

So friends if you want to enter the internal range liquidity, for example, you are trading the daily ranges you have to look for the one-hour market structure which is irl to erl or erl to irl.

On the higher time frame, you have to look for the swing highs to confirm your entry as valid you have to go to the lower time frame and then you have to check for the valid market structure Shift on the lowest time frame and then you can enter the trade.

In this example you can see that the market takes the external liquidity and targets the swing high so before Takes the swing high it could not move, This is why the market created a fair value gap as internal range liquidity, after creating the internal range liquidity the market will move for them and it will come to the internal range liquidity.

To know more about this you have to look at the displacement after it takes the external liquidity when it takes the external liquidity with heavy displacement it will leave A Fair value gap and order block inside that range.

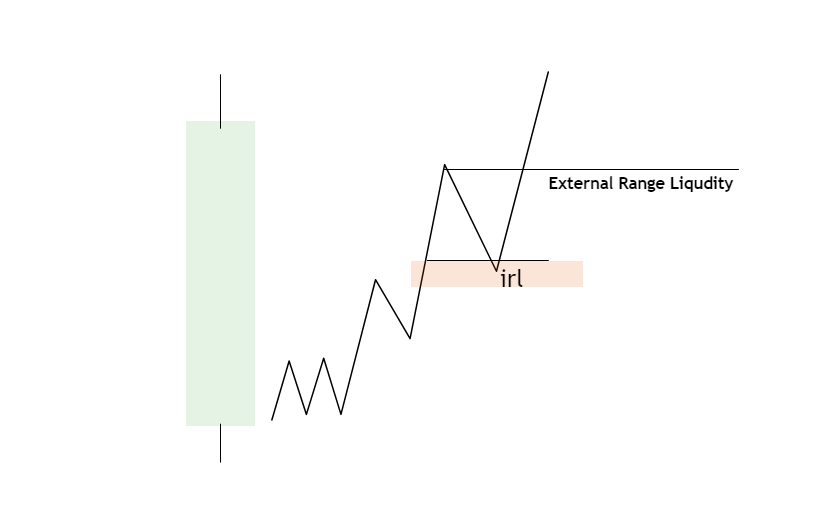

Advanced fractal of Irl To Erl Trading

When out trading this internal to external range liquidity fractal you will understand how the market moves, we all know that so I am repeating Once Again which is the market is run by an algorithm that is imbalance to liquidity and liquidity to imbalance.

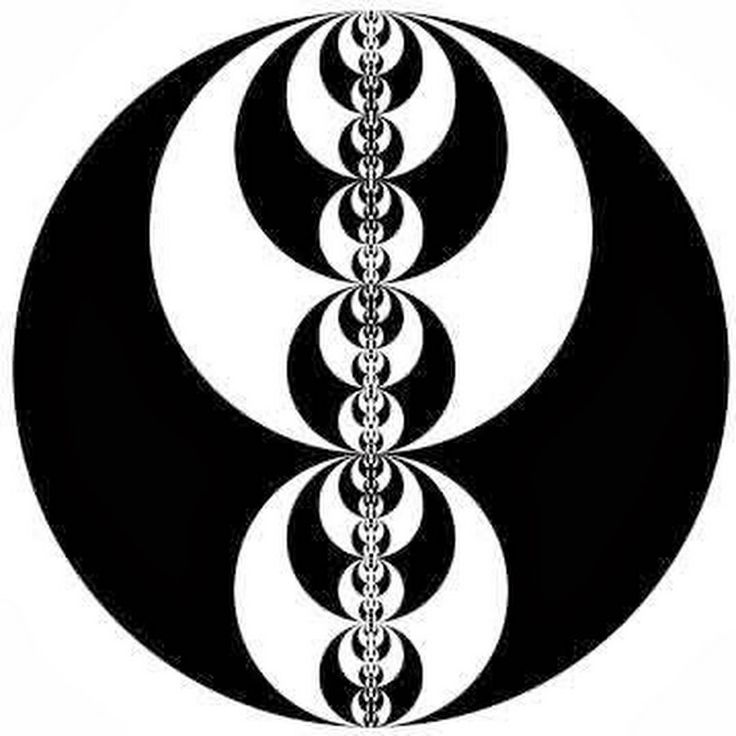

First of all, you have to understand what is meant by fractal, Fractal is moving candles that are very similar in every frame as Bullish you will see the exact thing that happens in the lower time frame this is called a factor in price action.

When the market moves in a single direction you will see the higher time frame fractals are printing as well as on the lower time frame.

You can trade the irl to erl on a higher time frame as well as you can trade that on a lower time frame so as we understand this much we can improve the quality of our trades and be profitable.

Final Thoughts

The inner circle trader is a genius nobody can explain the market price actions other than him we all use the ICT Concept for our technical analysis, using this internal range liquidity and external range liquidity we can increase our trading potentials and make some good money in it.

Always use the risk management and a proper mindset to be profitable in the market, at the end of the day you will be profitable by using this simple risk management, Thank you guys Happy trading.

Hi Iam, A Trader since 2019 And I have a Good Amount Of Experience In various Markets Forex, Futures, and Options and I using ict concepts since 2021 After Using ICT I became Profitable So I Created This Blog To Make Others Getting Knowledge On trading.