Hey hi, my dear friends if you are an ICT trader you are very curious about what an IPDA is and how To use it .so in this post I am going to explain how to use ICT IPDA data Ranges to make your trading better for long-term trading.

What Is ICT IPDA?

Interbank price delivery algorithm, Which is used to calculate the highs and lows of the 20-day 40 40-day, and 60-day.

To understand the ipda trading algorithm, first of all, we have to understand the higher time frame quarterly shifts. The quarterly shifts are every 3 -4 months the market will reset and change its direction like the image shown below :

In This price action, the eurusd has made a shift every 3-4 months, This is called a quarterly shift Every market will not run in the same direction for a year, because of the market makers.

The price will move from External to internal, In This Case, External Means Swing Highs And Lows And Internal Means the Fvg.

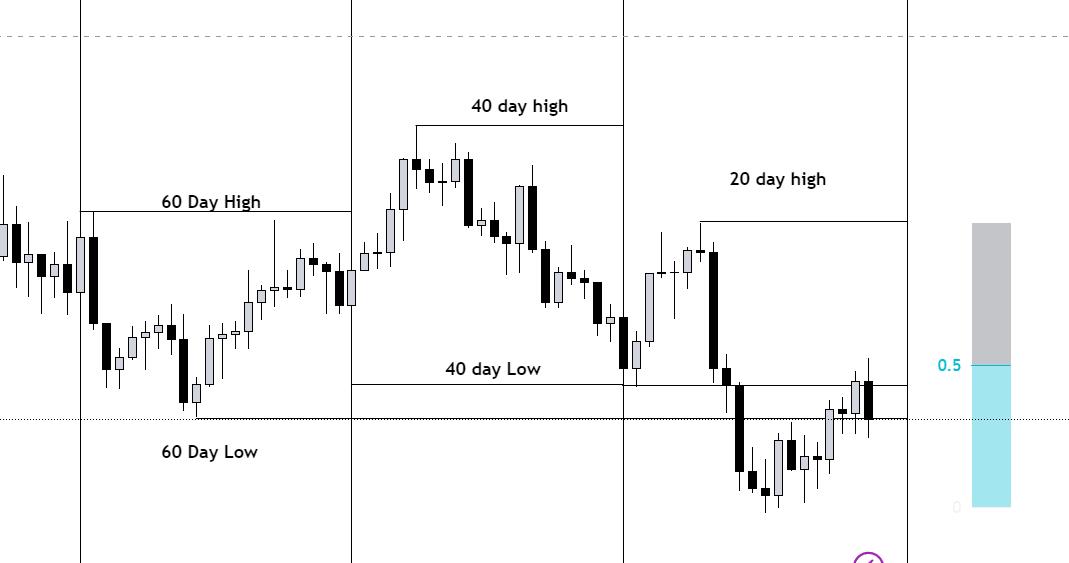

Understanding 20 40 60 Ipda Algorithm :

In this piece of price Action, You can see the last 20,40,60 days’ highs and lows, The 60-day highs and the lows were formed after the market made a new 40 days and the market was shifted its direction to bearish.

After taking liquidity from the 60 day’s highest the market needs to take the 60-day low, This is how the ipda – interbank price algorithm Was Designed, Now you can see that the market took the Highs and lows of the last 60 days’ highs and lows.

How To Trade Using Ipda Data Ranges.

After The Market Makes The New 20-day highs or the Lows Just wait to Take The Liquidity Of it Which means The Market Will Do a fake breakout on the last 20 days’ highs and lows.

Now Go to The Intraday chart and look for and specific tine window which is as ICT KILLZONES, Look For a Reversal Point, And enter The Fair value Gap.

Don’t trade this blindly wait for the right time to buy or sell, Now you can enjoy your profits and make decent profits wait for the market to Take the last 60 days low and book your profits.

Rules And Keys :

If you want to trade using this ipda data range Make Sure you are good at a daily bias and weekly bias, As the ICT has mentioned in his video the market will go for a Liqudity to imbalance and imbalance to liqudity.

The rules are very simple wait to take an external range liquidity and wait for a displacement on the opposite side of a range.

Don’t forget that the market always does a range which is consolidation to expansion not consolidation to Reversal.

If the price expands lower or higher wait for a retracement and enter on the fair value Gaps or An order block.

Don’t forget to do A Backtest and a Forward test, because when you are trained in your eyes you can easily Trade This Model and make money.

For Free Education Of Ict: Click Here

Final Thoughts :

If you are an ICT trader you can easily understand this concept, The ipda data ranges were taught by an inner circle trader all credit goes to him. If you want to know more you can follow us on the social handles thankyou have a great day.

Hi Iam, A Trader since 2019 And I have a Good Amount Of Experience In various Markets Forex, Futures, and Options and I using ict concepts since 2021 After Using ICT I became Profitable So I Created This Blog To Make Others Getting Knowledge On trading.

Pingback: ICT Fair Value Gaps - That Makes Money 2024

Hey Students!

Summer semester’s almost here! Get a head start and grab all your eTextbooks (over 15,000 titles in convenient PDF format!) at Cheapest Book Store. Save BIG on your studies with 20% off using code SUMMERVIBE24.

Still missing a book? No problem! Submit a request through our system and we’ll add it to our collection within 30 minutes. That’s right, you won’t be left scrambling for materials! ⏱️

Don’t wait – visit https://m.cheapestbookstore.com today and ace your summer semester!

Happy Learning!

Cheapest Book Store