Introduction

Hi, Ict traders if you trade ict concepts you all know that the inner circle trader has given the 5 pd arrays on the premium and discount, on that pd array one of the most important and well popular pd arrays is a fair value gap, on this post we are gonna learn how to use the fvg and how to identify them.

>Fair value Gaps – BISI, SIBI

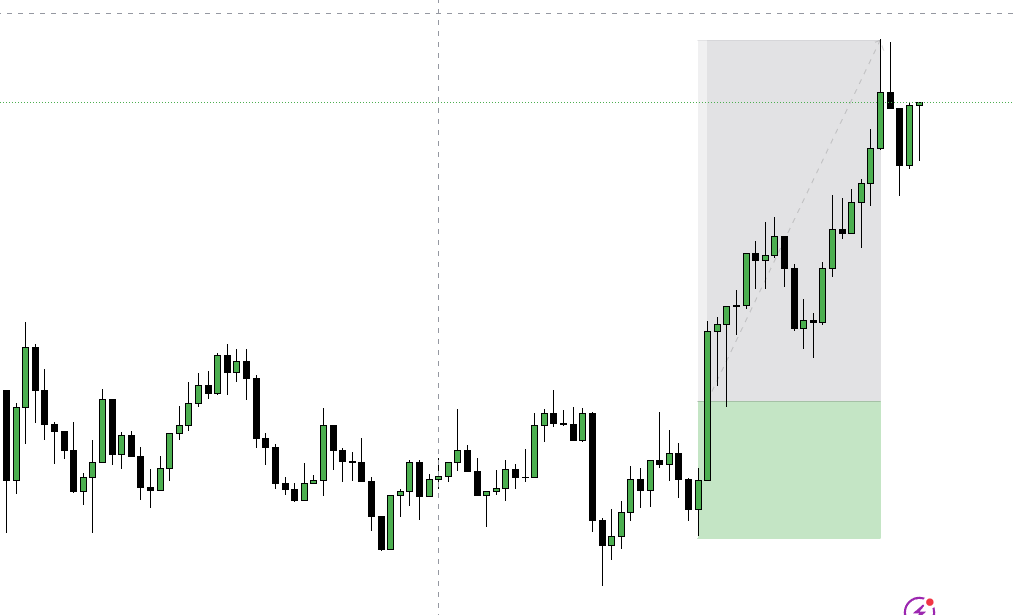

There are 2 types of fair value gaps, the one moves in the bullish direction is BISI – Buy side imbalance sell side inefficiency.

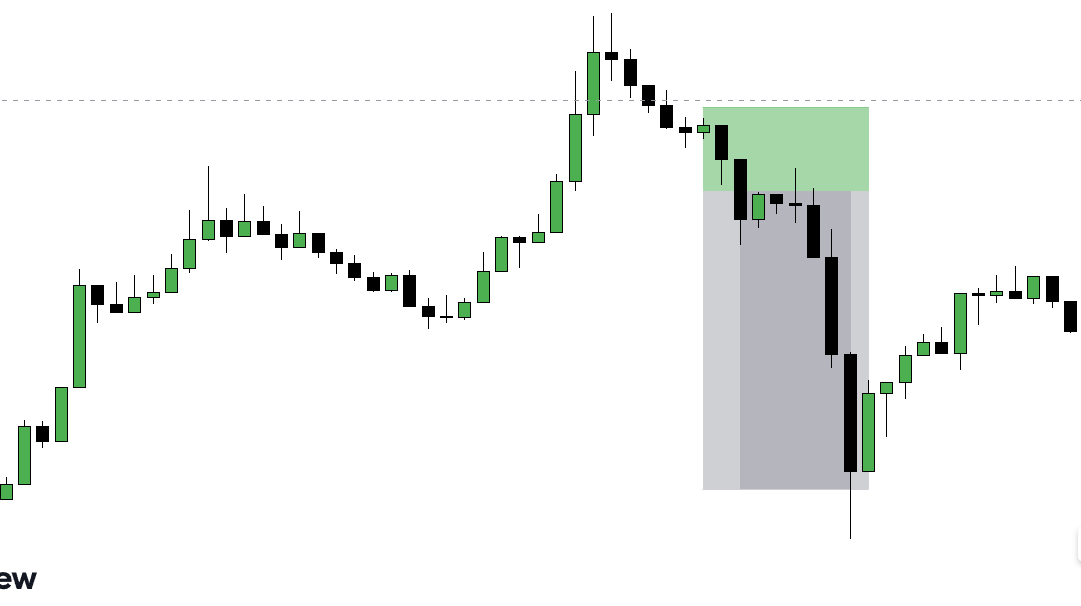

The price moves in the bearish direction are SIBI – Sell side imbalance buy side inefficiency.

How To Identify BISI : Bullish fvg

The Ict Fair value gap BISI Can Be easily identified by several steps on the mentorship of 2022 the ict gives a clear explanation about the fair value gaps, the bullish fvgs are easily identified after the price hits a certain key level.

If You want to take a high probability entry using this bullish fvg you can have to wait for the price to hit a certain key level, now you can see the lower time frame and you can place your trades.

How to Identify SIBI :

The Ict Bearish Fair Value Gap Can Be also Identified when the price hits a certain key level you can easily see this sell-side imbalance buy-side inefficiency gap, when you are confident in your bias and narrative you can enter both fair value gaps.

How Fair Value Gaps Form?

When the price hits a key level you can easily identify the displacement, when the price starts to displace lower or higher you can easily identify this ict fair value gaps, For a deeper understanding The Fvgs are formed using 3 candles.

On these 3 candles, the first candle will sweep the liquidity and the second candle will displace which is the expansion of the price this candle can do whatever it wants, when the third candle closes below the price will come back and tap the fvg and rally higher or lower.

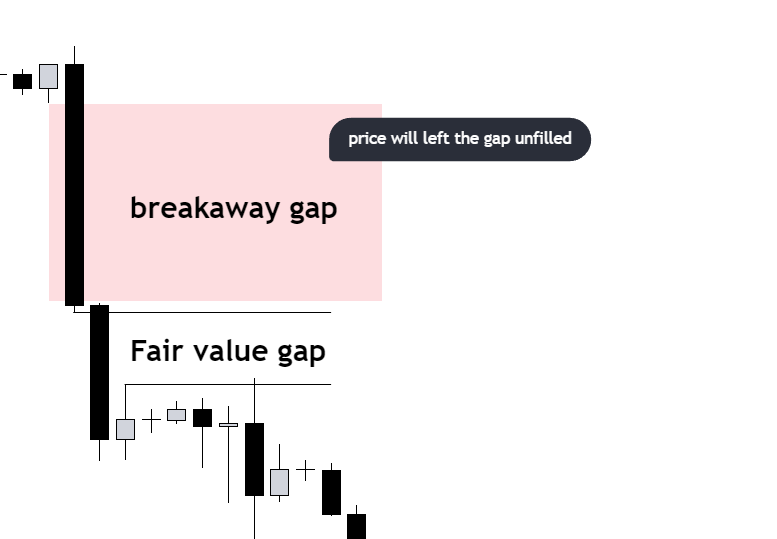

If you are long waiting for the third candle to close below the second candle’s high or the low which makes the bias stronger, there are some reasons for the fair value to not get filled that’s because of the breakaway gap.

Breakaway gaps vs fair value gaps :

Now everyone doubts that when the price can touch the fvg and rally higher, sometimes the price will not tap the fvg because of the breakaway gap the third candle will close above the 2nd candle and the price will move higher.

In the Above Example the first gap was not tapped by the price action this is because the second gap is the real fair value gap, the algorithm needs to be very quick to hit the draw on liquidity.

This is the reason for the price didn’t tap that gap which is unfilled and can be filled the next week or sometime when the price wants to move higher or lower.

Final Thoughts :

When you are using the fair value gaps also for a high probability entry wait for the market structure shift, if you watch the ict 2022 mentorship you can easily understand the MSS, this will give you a high probability winning rate.

Use Risk management and money management to make healthy trading psychology and have a good day, if you like us don’t forget to like and share the post with your friends stay safe.

Hi Iam, A Trader since 2019 And I have a Good Amount Of Experience In various Markets Forex, Futures, and Options and I using ict concepts since 2021 After Using ICT I became Profitable So I Created This Blog To Make Others Getting Knowledge On trading.

Pingback: ICT Order Block That Make You Profitable In 2024

Pingback: ICT Breaker Block Trading That Makes You Profitable 2024